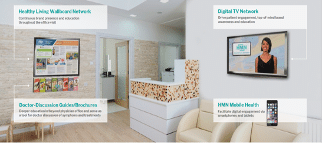

RF Investment Partners SBIC, LP (“RF” or the “Fund”) is pleased to announce that the Fund and its co-investors closed a debt and equity investment facilitating the minority recapitalization of Health Media Network (“HMN”). The RF-led investment provides HMN with growth capital to further expand the number of health care providers utilizing its platform. Based in Darien, CT, HMN provides digital point-of-care marketing services through its proprietary digital content platform. HMN’s digital networks run on screens placed in physician offices and provide specialty-specific, health-focused content tailored to patients’ health needs and interests.

“After meeting with the RF team, it was clear they were the right partner for HMN. Their team utilized a practical lens in crafting a capital solution uniquely structured to our business needs. RF’s investment allows the company to accelerate an already fast-growing platform. We look forward to partnering with the RF team, as we relentlessly focus on improving awareness of contemporary health issues and serving our customers.” – Christopher Culver, President and CEO of HMN

“Chris and his team have clearly built a best-of-breed player in the digital point-of-care marketing space. We continue to be impressed by HMN’s ability to execute on Chris’ vision for the Company. RF is excited to partner with an industry thought leader poised to capitalize on a compelling market opportunity.” – Peter Rothschild, Co-Founder and Managing Partner of RF

About RF Investment Partners

RF Investment Partners, with offices in New York and Chicago, provides capital ranging in size from $5 million to $25 million to support leading U.S.-based lower middle market companies with $2 million to $10 million of EBITDA. RF partners with family-owned and private businesses in a variety of situations, including: acquisition financing, growth capital investments, majority/minority recapitalizations, refinancings, and management buyouts. RF’s investment professionals have significant experience investing across the capital structure and have the flexibility to structure deals to meet the distinctive needs of each company and situation. RF invests in unitranche, subordinated, and mezzanine debt, alongside preferred, and common equity in both minority and majority positions.